Afsp Courses

Afsp Courses - Unenrolled return preparers can elect to voluntarily demonstrate completion of basic 1040 filing season tax preparation and other tax law training through continuing education. Access to all courses at $199. Learn how you can play a role in the fight to stop suicide. Our irs approved tax class is for tax preparers who want to take an irs afsp tax preparation course to complete their continuing education requirements. If you want to learn more about getting and keeping your afsp certification — including taking the right annual filing season program online courses — use this guide. This training ensures you meet irs requirements and maintain your tax certification. The irs annual filing season program (afsp) is an annual voluntary irs training program for tax preparers. Includes 24/7 access to annual filing season program courses and automatic reporting to the irs. Enrolled agents can get their ce or study for the ea exam with surgent. When you volunteer with afsp, you join thousands who share. Tax preparers can fulfill the ce requirements for the irs’s afsp record of completion. Unenrolled return preparers can elect to voluntarily demonstrate completion of basic 1040 filing season tax preparation and other tax law training through continuing education. When you volunteer with afsp, you join thousands who share. The illinois chapter of the american foundation for suicide prevention focuses on eliminating the loss of life from suicide through education, research, outreach, and advocacy. Earn your afsp record of completion with irs approved continuing education. This training ensures you meet irs requirements and maintain your tax certification. Includes 24/7 access to annual filing season program courses and automatic reporting to the irs. Access to all courses at $199. Learn how you can advocate for suicide prevention and mental health. The irs afsp continuing education program is intended to recognize and encourage unenrolled tax return preparers who want to voluntarily. When you volunteer with afsp, you join thousands who share. Unenrolled return preparers can elect to voluntarily demonstrate completion of basic 1040 filing season tax preparation and other tax law training through continuing education. Enrolled agents can get their ce or study for the ea exam with surgent. Stay current with the irs annual federal tax refresher course. Learn how. When you volunteer with afsp, you join thousands who share. Tax preparers can fulfill the ce requirements for the irs’s afsp record of completion. The irs annual filing season program (afsp) is an annual voluntary irs training program for tax preparers. Learn how you can advocate for suicide prevention and mental health. Our irs approved tax class is for tax. Learn how you can play a role in the fight to stop suicide. The irs annual filing season program (afsp) is an annual voluntary irs training program for tax preparers. If you want to learn more about getting and keeping your afsp certification — including taking the right annual filing season program online courses — use this guide. Access to. Our irs approved tax class is for tax preparers who want to take an irs afsp tax preparation course to complete their continuing education requirements. Enrolled agents can get their ce or study for the ea exam with surgent. Tax preparers can fulfill the ce requirements for the irs’s afsp record of completion. Access to all courses at $199. Earn. Learn how you can advocate for suicide prevention and mental health. The irs annual filing season program (afsp) is an annual voluntary irs training program for tax preparers. The irs afsp continuing education program is intended to recognize and encourage unenrolled tax return preparers who want to voluntarily. The illinois chapter of the american foundation for suicide prevention focuses on. Learn how you can advocate for suicide prevention and mental health. The irs annual filing season program (afsp) is an annual voluntary irs training program for tax preparers. Enrolled agents can get their ce or study for the ea exam with surgent. Earn your afsp record of completion with irs approved continuing education. Stay current with the irs annual federal. Earn your afsp record of completion with irs approved continuing education. Our irs approved tax class is for tax preparers who want to take an irs afsp tax preparation course to complete their continuing education requirements. Tax preparers can fulfill the ce requirements for the irs’s afsp record of completion. Access to all courses at $199. If you want to. If you want to learn more about getting and keeping your afsp certification — including taking the right annual filing season program online courses — use this guide. When you volunteer with afsp, you join thousands who share. The irs annual filing season program (afsp) is an annual voluntary irs training program for tax preparers. Earn your afsp record of. Access to all courses at $199. Learn how you can play a role in the fight to stop suicide. The irs afsp continuing education program is intended to recognize and encourage unenrolled tax return preparers who want to voluntarily. Earn your afsp record of completion with irs approved continuing education. Learn how you can advocate for suicide prevention and mental. Tax preparers can fulfill the ce requirements for the irs’s afsp record of completion. Includes 24/7 access to annual filing season program courses and automatic reporting to the irs. If you want to learn more about getting and keeping your afsp certification — including taking the right annual filing season program online courses — use this guide. Learn how you. Access to all courses at $199. If you want to learn more about getting and keeping your afsp certification — including taking the right annual filing season program online courses — use this guide. The illinois chapter of the american foundation for suicide prevention focuses on eliminating the loss of life from suicide through education, research, outreach, and advocacy. The irs annual filing season program (afsp) is an annual voluntary irs training program for tax preparers. Enrolled agents can get their ce or study for the ea exam with surgent. Includes 24/7 access to annual filing season program courses and automatic reporting to the irs. The irs afsp continuing education program is intended to recognize and encourage unenrolled tax return preparers who want to voluntarily. Tax preparers can fulfill the ce requirements for the irs’s afsp record of completion. Earn your afsp record of completion with irs approved continuing education. Stay current with the irs annual federal tax refresher course. This training ensures you meet irs requirements and maintain your tax certification. When you volunteer with afsp, you join thousands who share.AfSP Spring 2025 Courses African Studies Program University

Beyond AFSP AFTR Summary of important courses in tax preparation KIAN

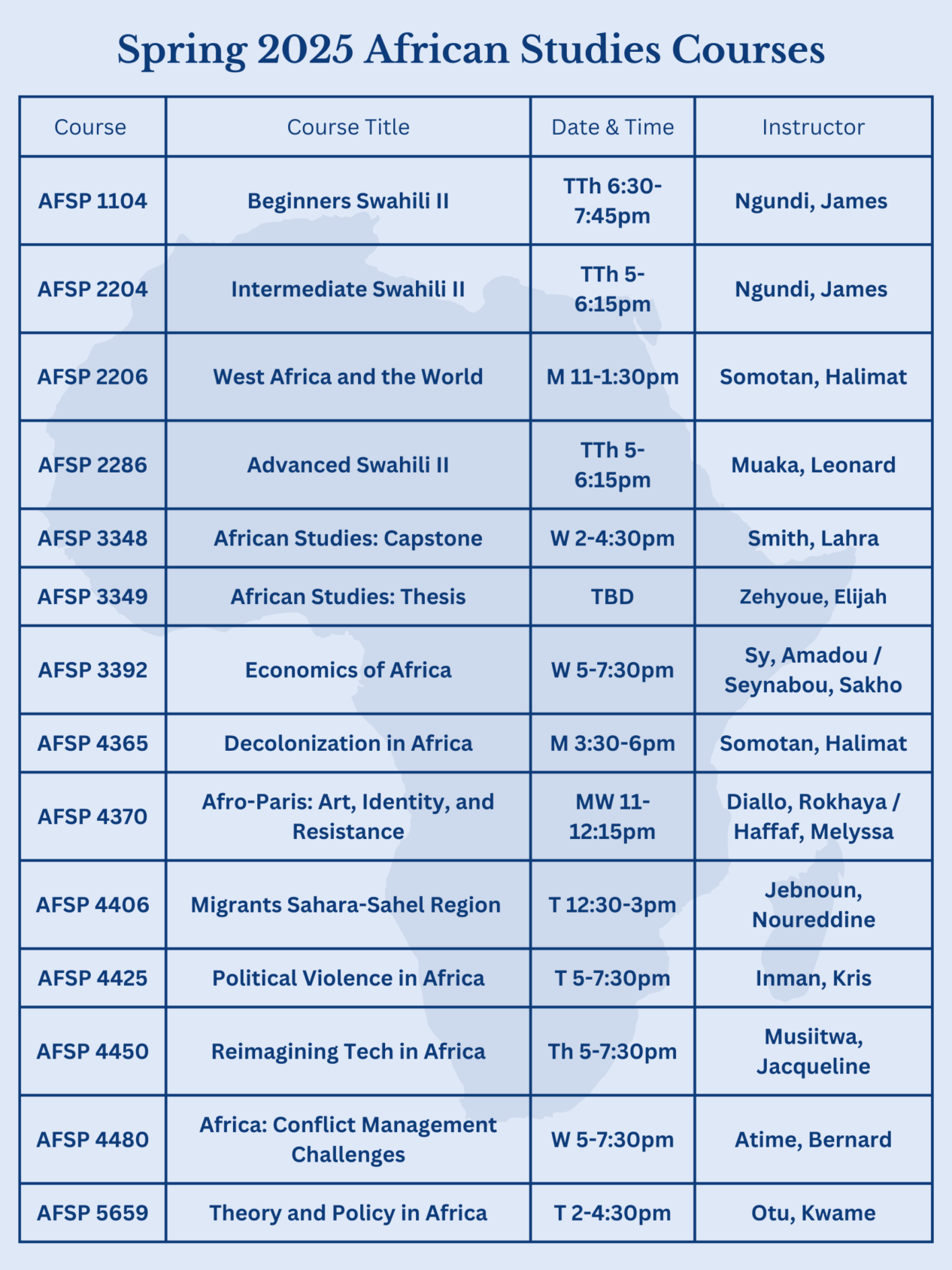

AfSP Spring 2025 Courses African Studies Program University

Everything you need to know about the Annual Filing Season Program

5 reasons to earn the AFSP Record of Completion Surgent CPE

Ultimate AFSP IRS Guide & Approved AFSP Courses [2021] Accounting

AFSP

Ultimate AFSP IRS Guide & Approved AFSP Courses [2021]

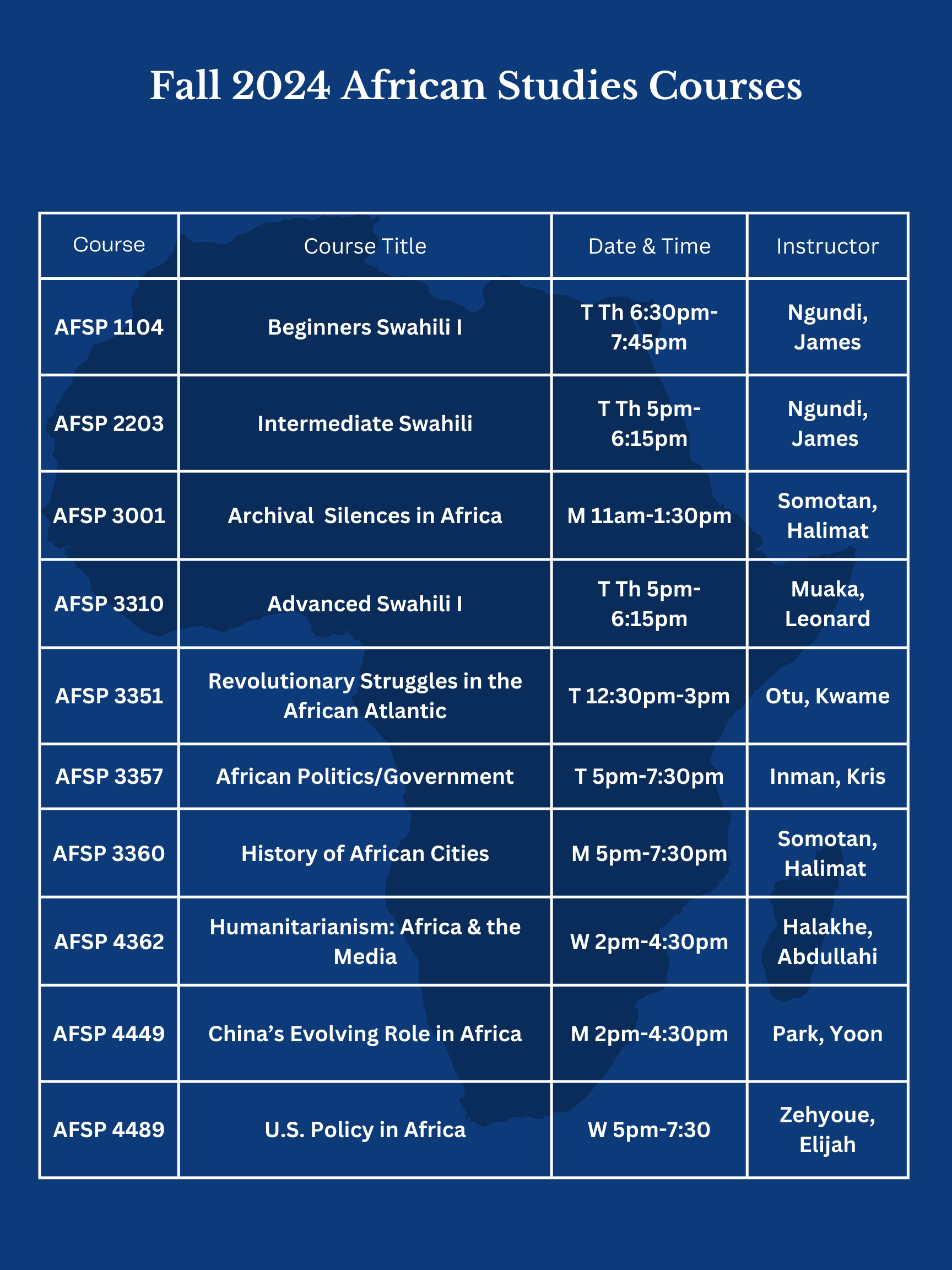

AfSP Fall 2024 Courses African Studies Program University

IRS AFSP(Tax Courses)

Learn How You Can Play A Role In The Fight To Stop Suicide.

Unenrolled Return Preparers Can Elect To Voluntarily Demonstrate Completion Of Basic 1040 Filing Season Tax Preparation And Other Tax Law Training Through Continuing Education.

Our Irs Approved Tax Class Is For Tax Preparers Who Want To Take An Irs Afsp Tax Preparation Course To Complete Their Continuing Education Requirements.

Learn How You Can Advocate For Suicide Prevention And Mental Health.

Related Post:

![Ultimate AFSP IRS Guide & Approved AFSP Courses [2021] Accounting](https://i.pinimg.com/originals/51/81/47/518147979ce7331e5a805205a2fb38f8.png)

![Ultimate AFSP IRS Guide & Approved AFSP Courses [2021]](https://ipassthecpaexam.com/wp-content/uploads/2020/08/ipassthecpaexam.com1_.png)