Cpa Course Cost

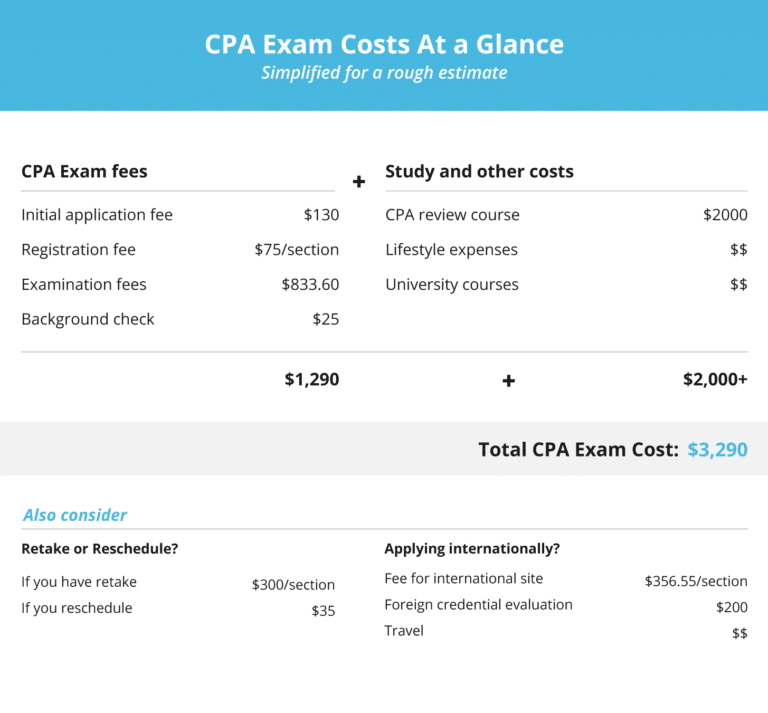

Cpa Course Cost - Simply choose flex pay during checkout and choose your desired length of plan. To become a licensed certified public accountant (cpa), you must meet the education, examination, and experience requirements. The fees for each of the four parts of the cpa exam are. Learn about the fees for review courses, cpa exam, ethics exam and certificate application. To be a licensed cpa, you will pay ongoing aicpa membership fees and other costs associated with your cpa license. Allows firm employees to complete their additional 30 credit hours. Find out how to save money and time with becker's cpa review course and pass guarantee. Cpa review courses significantly affect preparation costs, so evaluating options for cost vs. This table provides an overview of one. Get 35% off a cpa review pro package + $898 in support products free with purchase! All candidates must pass the uniform. Pass guaranteepersonalized contentmobile app access Find the 5 major types of cpa exam costs and licensure fees including application, examination, registration, ethics exam fees & cpa prep course costs. Passing the cpa exam without a solid cpa exam review course is extremely rare. Course materials and resources to prepare for the cpa exam present another variable cost, with prices that can range from a few hundred dollars to several thousand. Cpa review courses significantly affect preparation costs, so evaluating options for cost vs. The total cost of obtaining a cpa license can range from $1,600 to $8,000, depending on state fees and review course selection. Chat support available11 million+ servedask live. The certified public accountant (cpa) exam, also known as the uniform cpa exam, assesses the core skills you need to become a public accountancy professional. These include fees for applying, fees for each part of the exam, registration fees, and extra fees for people taking the exam outside the united states, which are called us cpa. According to credit karma, the nation’s average cost of tuition for one year of school at a public university is $17,702. Most states adhere to the fee schedule set by the national association of state boards of accountancy (nasba). Get 35% off a cpa review pro package + $898 in support products free with purchase! The fees for each of. Most states adhere to the fee schedule set by the national association of state boards of accountancy (nasba). The certified public accountant (cpa) exam, also known as the uniform cpa exam, assesses the core skills you need to become a public accountancy professional. Passing the cpa exam without a solid cpa exam review course is extremely rare. Cpa exam review. What makes becker the #1 choice for cpa exam prep? The fees for each of the four parts of the cpa exam are. To become a licensed certified public accountant (cpa), you must meet the education, examination, and experience requirements. This table provides an overview of one. Learn about the fees for review courses, cpa exam, ethics exam and certificate. According to credit karma, the nation’s average cost of tuition for one year of school at a public university is $17,702. Find out how to save money and time with becker's cpa review course and pass guarantee. This does not include any retake costs, any cpa exam review materials, or any other fees. Simply choose flex pay during checkout and. Most states adhere to the fee schedule set by the national association of state boards of accountancy (nasba). According to credit karma, the nation’s average cost of tuition for one year of school at a public university is $17,702. Find out how to save money and time with becker's cpa review course and pass guarantee. A master's degree with the. Licensing fees differ by state, impacting both initial licensure and renewal. Cpa review courses significantly affect preparation costs, so evaluating options for cost vs. Find the 5 major types of cpa exam costs and licensure fees including application, examination, registration, ethics exam fees & cpa prep course costs. All candidates must pass the uniform. These include fees for applying, fees. The certified public accountant (cpa) designation is a mark of excellence within the united states’ accounting profession. This table provides an overview of one. According to credit karma, the nation’s average cost of tuition for one year of school at a public university is $17,702. Passing the cpa exam without a solid cpa exam review course is extremely rare. To. Most states adhere to the fee schedule set by the national association of state boards of accountancy (nasba). These include fees for applying, fees for each part of the exam, registration fees, and extra fees for people taking the exam outside the united states, which are called us cpa. Allows firm employees to complete their additional 30 credit hours. Between. This table provides an overview of one. Get 35% off a cpa review pro package + $898 in support products free with purchase! Between the application fees and review courses, the cost can reach $4,000 or more depending on your state and how many times you take the exam. Course materials and resources to prepare for the cpa exam present. Cpa exam costs ($) education evaluation application fee:. Simply choose flex pay during checkout and choose your desired length of plan. Cpa exam costs vary significantly: According to credit karma, the nation’s average cost of tuition for one year of school at a public university is $17,702. Most states adhere to the fee schedule set by the national association of. Find the 5 major types of cpa exam costs and licensure fees including application, examination, registration, ethics exam fees & cpa prep course costs. Cpa exam review course costs. A master's degree with the required accounting coursework, one year of experience and passing the cpa exam; Licensing fees differ by state, impacting both initial licensure and renewal. Passing the cpa exam without a solid cpa exam review course is extremely rare. Get 35% off a cpa review pro package + $898 in support products free with purchase! Cpa review courses significantly affect preparation costs, so evaluating options for cost vs. What makes becker the #1 choice for cpa exam prep? Learn how much the cpa exam costs and what fees you need to pay for each section and state. The certified public accountant (cpa) exam, also known as the uniform cpa exam, assesses the core skills you need to become a public accountancy professional. Most states adhere to the fee schedule set by the national association of state boards of accountancy (nasba). Course materials and resources to prepare for the cpa exam present another variable cost, with prices that can range from a few hundred dollars to several thousand. The total cost of the cpa exam typically ranges from $1,000 to $3,000, depending on your jurisdiction, review course selection, and other related expenses. This table provides an overview of one. Simply choose flex pay during checkout and choose your desired length of plan. Learn about the fees for review courses, cpa exam, ethics exam and certificate application.CPA Course Details Certification Eligibility, Duration, Fees, Career

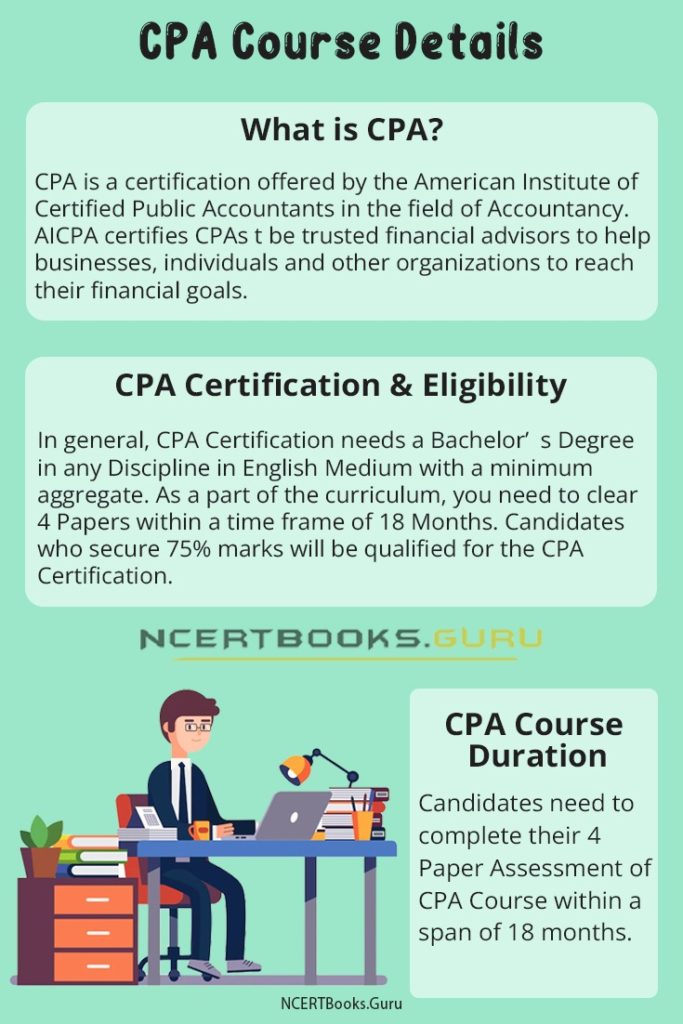

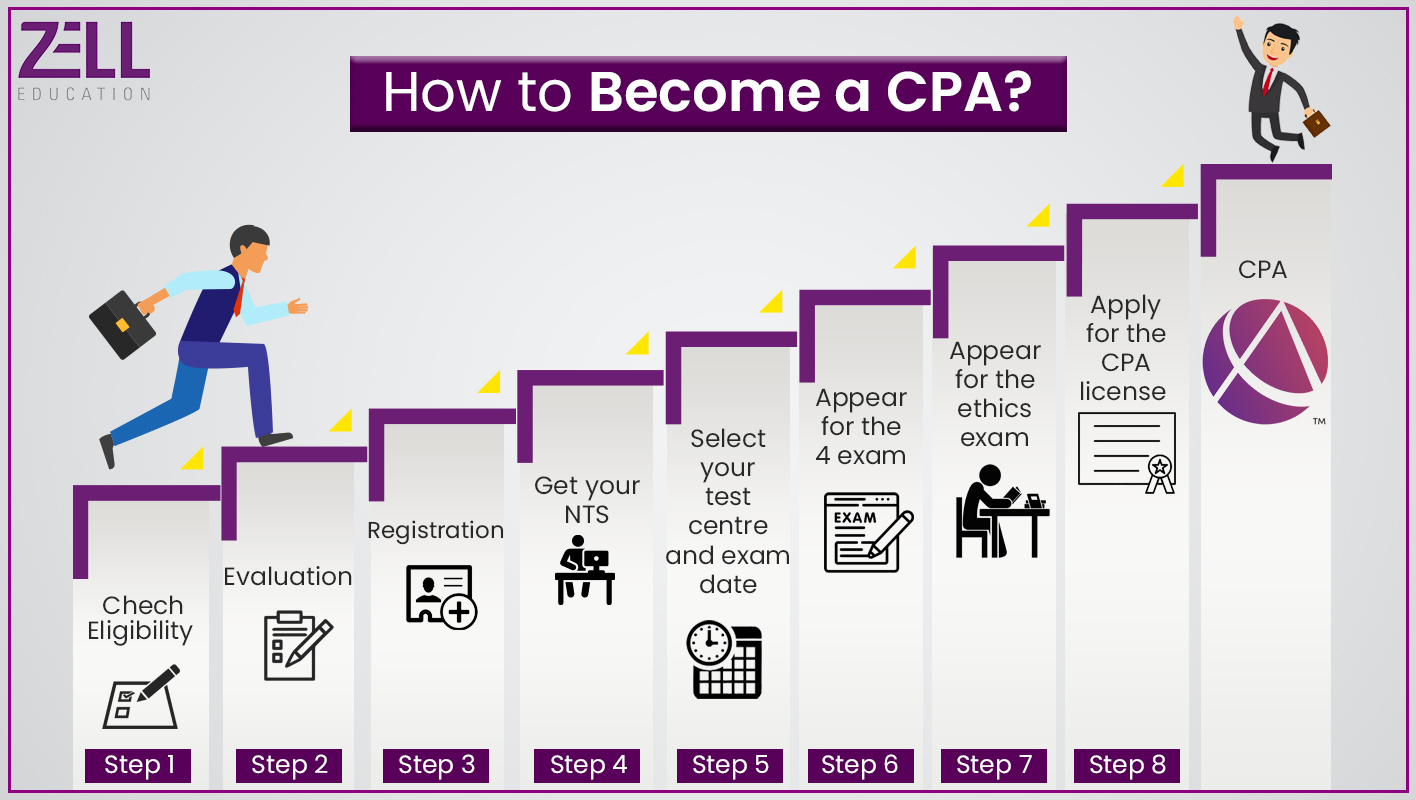

CPA Course Details Eligibility Criteria, Fee, Duration, Jobs, Scope

Unlock Your Accounting Career Potential with a US CPA Certification

CPA Exam cost CPA Course Fee in India CPA Exam Fee (2022) cpa

CPA Exam Cost What Every Candidate Needs to Know Miami Herald

The 5 Biggest CPA Exam Costs & License Fees [2025 Update]

(1) Zell Education

How Much Is The CPA Exam? (Guide To Costs & Fees)

CPA Exam Fees

Everything about CPA Course, Eligibility, Exam, Fees CPA CPA Course

All Candidates Must Pass The Uniform.

This Does Not Include Any Retake Costs, Any Cpa Exam Review Materials, Or Any Other Fees.

Find Out How To Save Money With Mncpa Discounts And Military Reimbursement.

Cpa Exam Costs Vary Significantly:

Related Post: