Private Equity Interview Course

Private Equity Interview Course - Get instant access to lessons taught by experienced private equity pros and bulge bracket investment bankers including financial statement modeling, dcf, m&a, lbo, comps and excel modeling. We help you become the most competitive candidate you can be. Learn to analyze private equity investments, blending investment theory with real world analysis as it is done at the world’s leading private equity investment firms. The private equity interview process for most firms tends to have two or three interview rounds. Get 27 financial modeling templates in swipe file We've aggregated interview questions from mds and headhunters at the top firms. Cfa institute launches the advanced private equity certificate, a new online certificate building on the existing private equity certificate to equip private equity professionals with advanced skills in investment management and partnership governance. Why did you choose investment banking/consulting? Get insider tips from a private equity partner and watch an example of a successful interview with answers and detailed feedback. Perfect if you’ve got some experience and need to refine your interview skills to ace that crucial step. Prepare for your interview with expert advice. Gain exclusive access to our private equity interview course, designed to equip you with the skills and knowledge necessary to stand out among the top 1% of pe applicants and secure positions in the industry. Get instant access to lessons taught by experienced private equity pros and bulge bracket investment bankers including financial statement modeling, dcf, m&a, lbo, comps and excel modeling. We've aggregated interview questions from mds and headhunters at the top firms. However, they can be more depending on the firm. Prepares you for interviews at tier 1 private equity funds. Discover what firms are looking for, the key areas covered and how to prepare for your best pitch in the private equity interview course. The private equity interview process for most firms tends to have two or three interview rounds. Access 30,323 interview questions across thousands of firms (investment banks, private equity & hedge funds and consulting firms) access realistic templates and countless actual modeling tests used in superdays and the private equity interview process Get 27 financial modeling templates in swipe file We help you become the most competitive candidate you can be. Discover what firms are looking for, the key areas covered and how to prepare for your best pitch in the private equity interview course. You'll learn directly from wharton school faculty, top pe corporate training instructors and senior executives at some of the world's leading private equity firms. (so. Everything you need to break into a top fund! Technical questions are a critical component of. Relevant for associate, analyst, and intern roles. Including financial modeling exercises from leading training providers, financial edge. You’ll take the learnings home with custom drills and walk through a full 1:1 mock interview with an expert coach. Perfect if you’ve got some experience and need to refine your interview skills to ace that crucial step. Everything you need to break into a top fund! Prepare for your interview with expert advice. The course covers a wide range of lbo case formats, including different variations and edge cases. Including financial modeling exercises from leading training providers, financial edge. Access 30,323 interview questions across thousands of firms (investment banks, private equity & hedge funds and consulting firms) access realistic templates and countless actual modeling tests used in superdays and the private equity interview process Relevant for associate, analyst, and intern roles. Page covers 9 sample answers tailored for students and professionals looking to break into private equity. However, they. Our flagship program has placed mentees into most major private equity firms since launching in 2020. Perfect if you’ve got some experience and need to refine your interview skills to ace that crucial step. Discover what firms are looking for, the key areas covered and how to prepare for your best pitch in the private equity interview course. Investment frameworks,. Our private equity recruiting bootcamp is designed to equip candidates with both the tactical skills and intuitive understanding necessary for private equity associate recruiting. Page covers 9 sample answers tailored for students and professionals looking to break into private equity. Land a top equity research job by preparing efficiently. There are a few things that will get asked in every. However, they can be more depending on the firm. Investment frameworks, deal structuring, lbo modeling, valuation methods, and more. In this course, you will master the theory and practical skills behind the different lbo modeling tests required to ace your private equity interview. Detailed models, thorough case studies, and how to explain deals. Discover what firms are looking for, the. Why do you want to pursue a career in private equity? Technical questions are a critical component of. Including financial modeling exercises from leading training providers, financial edge. Prepare for your interview with expert advice. Our private equity recruiting bootcamp is designed to equip candidates with both the tactical skills and intuitive understanding necessary for private equity associate recruiting. Investment frameworks, deal structuring, lbo modeling, valuation methods, and more. (so you can ace even the most technical modelling tests) There are a few things that will get asked in every single interview you have, from initial headhunter meetings to chats with the most senior partners. Cfa institute launches the advanced private equity certificate, a new online certificate building on. Learn to analyze private equity investments, blending investment theory with real world analysis as it is done at the world’s leading private equity investment firms. (so you can ace even the most technical modelling tests) We've aggregated interview questions from mds and headhunters at the top firms. Discover what firms are looking for, the key areas covered and how to. We'll give you real, comprehensive models and resumes based on the actual deals and interviews we just went through. Access 30,323 interview questions across thousands of firms (investment banks, private equity & hedge funds and consulting firms) access realistic templates and countless actual modeling tests used in superdays and the private equity interview process Detailed models, thorough case studies, and how to explain deals. Discover what firms are looking for, the key areas covered and how to prepare for your best pitch in the private equity interview course. The course covers a wide range of lbo case formats, including different variations and edge cases. We've aggregated interview questions from mds and headhunters at the top firms. Learn to analyze private equity investments, blending investment theory with real world analysis as it is done at the world’s leading private equity investment firms. Investment frameworks, deal structuring, lbo modeling, valuation methods, and more. Including financial modeling exercises from leading training providers, financial edge. Prepares you for interviews at tier 1 private equity funds. You'll learn directly from wharton school faculty, top pe corporate training instructors and senior executives at some of the world's leading private equity firms. However, they can be more depending on the firm. Relevant for associate, analyst, and intern roles. You’ll take the learnings home with custom drills and walk through a full 1:1 mock interview with an expert coach. Get 27 financial modeling templates in swipe file Get instant access to lessons taught by experienced private equity pros and bulge bracket investment bankers including financial statement modeling, dcf, m&a, lbo, comps and excel modeling.WSO Private Equity Interview Bootcamp 1 Day Wall Street Oasis

private equity case study interview example

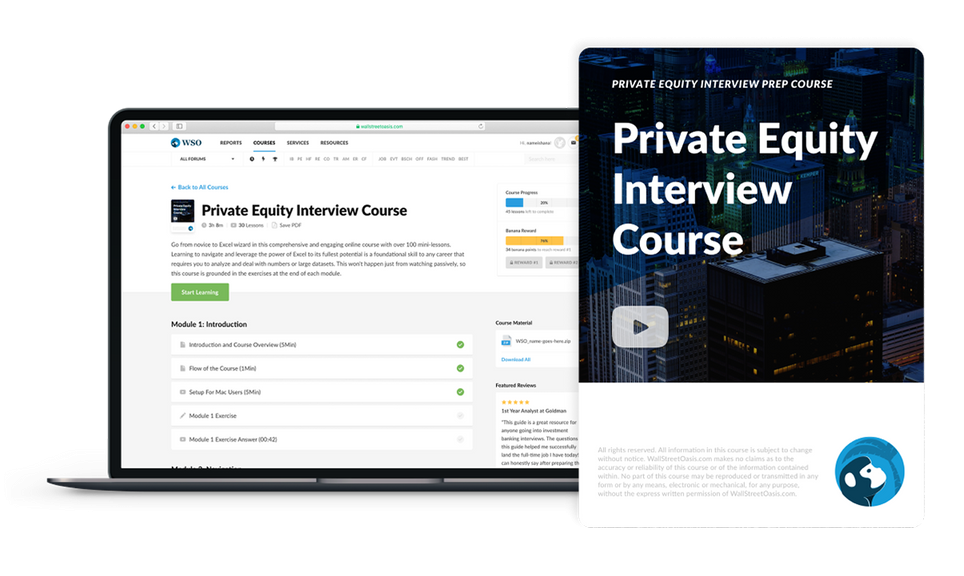

WSO Private Equity Interview Course Wall Street Oasis

Private Equity Interviews Detailed Guide & Case Studies

Private Equity Interview Course Wall Street Oasis PDF PDF Leveraged

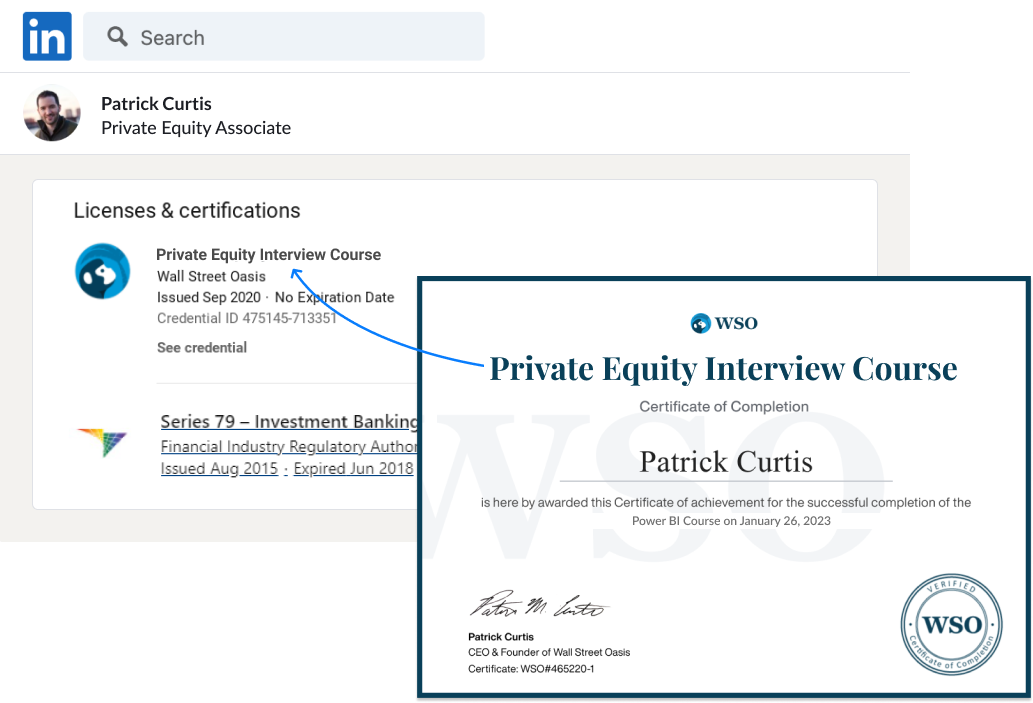

Private Equity Interview Course Recognized Skills Certification

What Is Private Equity PE Interviews OfficeHours

How to Ace Private Equity Interviews Beyond the Paper LBO Training LBO

Mastering The Art Of The Private Equity Interview OfficeHours

Private Equity Interview Primer Career Development Yale School of

After Completing The Private Equity Interview Course, You'll Have A Strong Edge Over Other Candidates In Landing A Position In Private Equity.

No More Wasted Time Studying Outdated Materials.

The Private Equity Interview Process For Most Firms Tends To Have Two Or Three Interview Rounds.

(So You Can Ace Even The Most Technical Modelling Tests)

Related Post: