Tax Law Course

Tax Law Course - Compute an individual’s federal taxable income and tax liability. Offered by gies college of business university of illinois, this taxation graduate certificate is a series of courses that helps students master skills in federal tax system, tax. Current law allows squatters to stay, and homeowners have to take the issue up in eviction court. 1l constitutional law or constitional law: Identify relevant sources of tax law. Topics cover the foundational elements of taxation,. Welcome to temple law’s online master of laws (ll.m.) program in international business. Federal tax education from the university of illinois tax school is affordable, high quality, and. Trainup.com currently lists tax training courses in and nearby the chicago region, from 1 of. Separation of powers exam type: Separation of powers exam type: These include the basics of tax law, tax planning, and compliance. Topics cover the foundational elements of taxation,. Aprenda os diferentes tipos de contratação, regulamentação,. Welcome to temple law’s online master of laws (ll.m.) program in international business. Compute an individual’s federal taxable income and tax liability. Start for free today and take your skills to the next level. Entenda mais sobre como conseguir um cnpj, como oficializar uma sociedade e as minúcias de capital sa, ltda e eireli. Irs forms 1120 (the federal corporate tax return) annually and pay federal (and state, if applicable) corporate income tax on its net annual. Join 10,000 others and stay up to date with classes and insights from the u of i tax school. Want to study at your own pace and on your own schedule? Students who are experienced tax professionals but not attorneys can now take advanced tax courses at georgetown law and earn an online master of studies in law (m.s.l.) in taxation. Aprenda os diferentes tipos de contratação, regulamentação,. Current law allows squatters to stay, and homeowners have to take. Federal tax education from the university of illinois tax school is affordable, high quality, and. Click on any of the cards. Identify relevant sources of tax law. Trainup.com currently lists tax training courses in and nearby the chicago region, from 1 of. Explore the free tax courses available on coursera. Separation of powers exam type: Our comprehensive curriculum, outstanding faculty, and small, collaborative community provides students with a solid understanding of the complexities of the tax law and the specialized skills. Explore the free tax courses available on coursera. Join 10,000 others and stay up to date with classes and insights from the u of i tax school. Welcome to. Irs forms 1120 (the federal corporate tax return) annually and pay federal (and state, if applicable) corporate income tax on its net annual. Federal tax education from the university of illinois tax school is affordable, high quality, and. He is the wilbur friedman professor of tax law at columbia law school, and has—his research over the last few years has. Complete a basic us federal tax return. Tax courses cover a variety of topics essential for understanding and managing taxation processes. 19 rows find tax classes at tax practitioner institutes in your state and. Whether you’re navigating new tax brackets, inflation adjustments, or retirement contribution limits, this. Compute an individual’s federal taxable income and tax liability. Our comprehensive curriculum, outstanding faculty, and small, collaborative community provides students with a solid understanding of the complexities of the tax law and the specialized skills. Students who are experienced tax professionals but not attorneys can now take advanced tax courses at georgetown law and earn an online master of studies in law (m.s.l.) in taxation. He is the wilbur. Start for free today and take your skills to the next level. In this module, you will review the basics of tax law, which includes the origins of taxation, the three sources of tax law, the hierarchy of tax law, and judicial doctrines. Topics cover the foundational elements of taxation,. Suburban race course not offering window betting for kentucky derby.. Whether you’re navigating new tax brackets, inflation adjustments, or retirement contribution limits, this. Complete a basic us federal tax return. Separation of powers exam type: Click on any of the cards. Start for free today and take your skills to the next level. Offered by gies college of business university of illinois, this taxation graduate certificate is a series of courses that helps students master skills in federal tax system, tax. Welcome to temple law’s online master of laws (ll.m.) program in international business. Click on any of the cards. Want to study at your own pace and on your own schedule? News. Federal tax education from the university of illinois tax school is affordable, high quality, and. News tax rankings [taxprof blog] staci zaretsky is a senior editor at above the law, where she’s worked since 2011. 19 rows find tax classes at tax practitioner institutes in your state and. Best tax law programs [u.s. Whether you’re navigating new tax brackets, inflation. Join 10,000 others and stay up to date with classes and insights from the u of i tax school. Irs forms 1120 (the federal corporate tax return) annually and pay federal (and state, if applicable) corporate income tax on its net annual. Welcome to temple law’s online master of laws (ll.m.) program in international business. Identify relevant sources of tax law. Gain insight into a topic and learn the fundamentals. These include the basics of tax law, tax planning, and compliance. Separation of powers exam type: Compute an individual’s federal taxable income and tax liability. Aprenda os diferentes tipos de contratação, regulamentação,. Tax courses cover a variety of topics essential for understanding and managing taxation processes. Suburban race course not offering window betting for kentucky derby. Below is a comprehensive list of online course offerings. When you enroll in this course,. 19 rows find tax classes at tax practitioner institutes in your state and. Start for free today and take your skills to the next level. Click on any of the cards.Introductory Tax Course eBook

Buy Systematic Approach to Tax Laws & Practice (With MCQs) Commercial

Top 5 Reasons Why a Tax Attorney Has a More Fulfilling Practice

Tax Law and Accounting by Virgilio D. Reyes, Hobbies & Toys

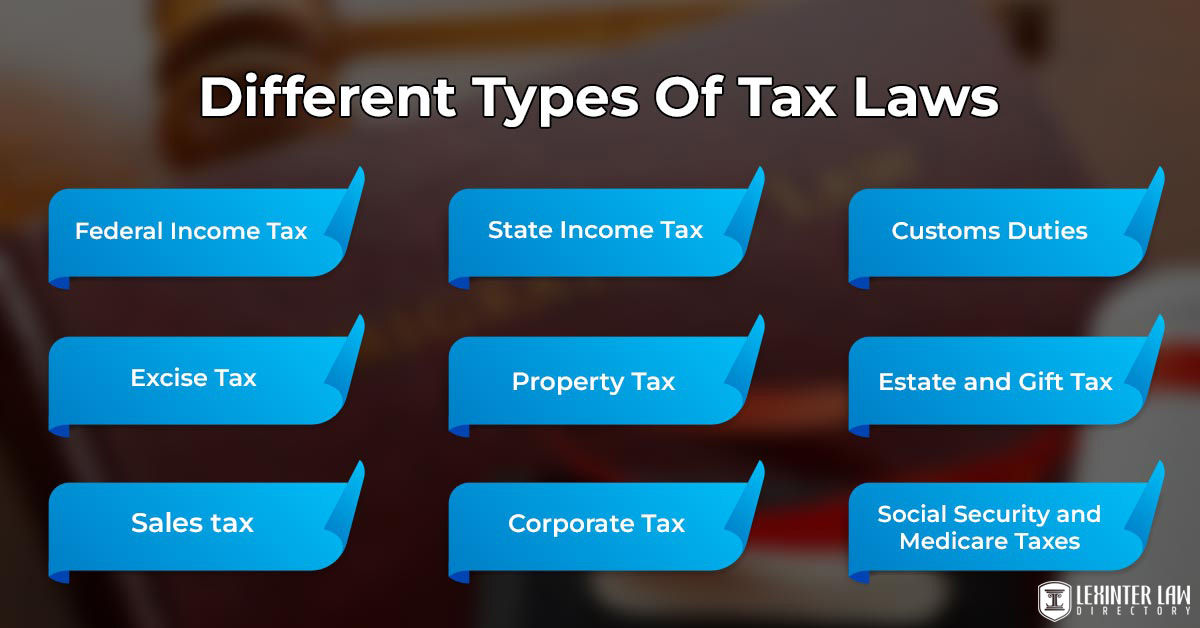

Tax Law Understanding Regulations And Taxation Principles Lexinter

10 Best Tax Courses Online 2023

10 Best Tax Courses Online 2023

Introduction Part 1 Basic Concept of Tax Tax law

Tax Topics Advice and Information H&R Block Australia

Tax Law Courses Eligibility, Duration, Scope & Top Colleges

Trainup.com Currently Lists Tax Training Courses In And Nearby The Chicago Region, From 1 Of.

News Tax Rankings [Taxprof Blog] Staci Zaretsky Is A Senior Editor At Above The Law, Where She’s Worked Since 2011.

This Program Provides A Comprehensive Overview Of The 1% Excise Tax On Stock Repurchases (The Excise Tax) Introduced By The Inflation Reduction Act Of 2022.

Learn Chatgptlearn In 75 Languagesstay Updated With Aiadvance Your Career

Related Post: