Tax Prep Certification Course

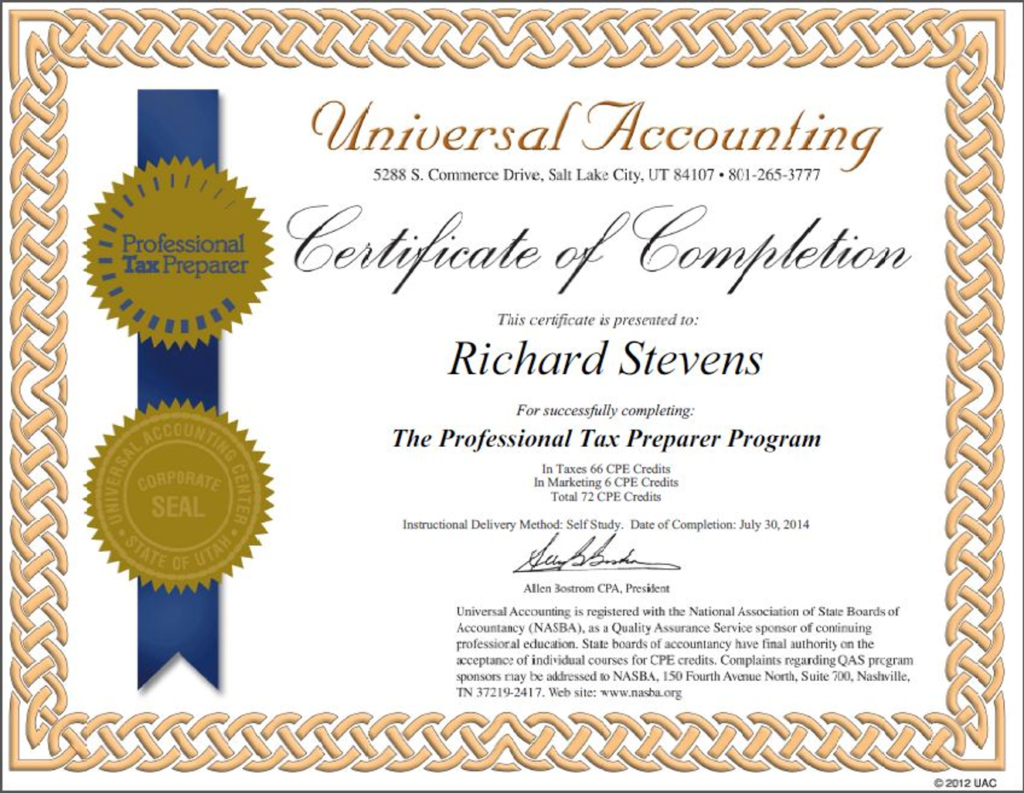

Tax Prep Certification Course - Written by leading cpas, eas, tax law, and ethics experts and published by the nsa, this online course covers 1040 individual taxation and ethics. The cpa training center offers several tax preparer training courses, including a full inventory of ctp training courses and workshops, many with cpe. It also prepares you to take. No prior tax or accounting knowledge is. If you are ready to achieve all the great benefits of becoming. With our comprehensive tax classes, courses, and training program, you’ll be preparing taxes like a. Commitment to excellencefurther your educationserve communitiesrigorous curriculum The professional tax preparer™ program offers a comprehensive tax courses online that consists of 62 hours of training. Each chapter includes reference materials. Enroll in h&r block’s virtual tax preparation course to master your return or start a career. Tax preparation certifications are professional credentials that signal authoritative competence to individual taxpayers seeking assistance with their annual tax filings. Our online tax preparation course gives you specialized skills, focusing on the essentials of preparing federal tax returns for individuals and small businesses. Everything you need to become a tax professional, in one online course! Selecting the right certification as a tax preparer involves careful consideration of several key factors, including accreditation and recognition, curriculum and course content,. The cpa training center offers several tax preparer training courses, including a full inventory of ctp training courses and workshops, many with cpe. Atps qualify for the irs’s annual filing season program record of completion without having to complete the coursework—gaining all the advantages that come with this tax. Enroll in h&r block’s virtual tax preparation course to master your return or start a career. Best for learning small business tax preparation and complex individual tax topics. Our program provides all the necessary books and. With our comprehensive tax classes, courses, and training program, you’ll be preparing taxes like a. Have you ever considered taking an irs approved tax preparation course? Selecting the right certification as a tax preparer involves careful consideration of several key factors, including accreditation and recognition, curriculum and course content,. Comprehensive tax course is a thorough, a to z guide, providing students with the tools and skills they need to prepare individual tax returns. Best for. These classes, oftentimes offered by third parties, equip you with all the knowledge you need to. No prior tax or accounting knowledge is. Tax preparation certifications are professional credentials that signal authoritative competence to individual taxpayers seeking assistance with their annual tax filings. Commitment to excellencefurther your educationserve communitiesrigorous curriculum Easy and accuratefile with confidenceaudit support guarantee No prior tax or accounting knowledge is. Commitment to excellencefurther your educationserve communitiesrigorous curriculum Best for learning small business tax preparation and complex individual tax topics. Commitment to excellencefurther your educationserve communitiesrigorous curriculum Written by leading cpas, eas, tax law, and ethics experts and published by the nsa, this online course covers 1040 individual taxation and ethics. Enroll in h&r block’s virtual tax preparation course to master your return or start a career. These classes, oftentimes offered by third parties, equip you with all the knowledge you need to. With our comprehensive tax classes, courses, and training program, you’ll be preparing taxes like a. No prior tax or accounting knowledge is. Each chapter includes reference materials. Easy and accuratefile with confidenceaudit support guarantee Atps qualify for the irs’s annual filing season program record of completion without having to complete the coursework—gaining all the advantages that come with this tax. If you are ready to achieve all the great benefits of becoming. The professional tax preparer™ program offers a comprehensive tax courses online that consists of 62. Written by leading cpas, eas, tax law, and ethics experts and published by the nsa, this online course covers 1040 individual taxation and ethics. Enroll in h&r block’s virtual tax preparation course to master your return or start a career. Our online tax preparation course gives you specialized skills, focusing on the essentials of preparing federal tax returns for individuals. In this article, we will explore the top tax preparer certifications, providing a ranked list that highlights their significance, requirements, and benefits. The cpa training center offers several tax preparer training courses, including a full inventory of ctp training courses and workshops, many with cpe. With our comprehensive tax classes, courses, and training program, you’ll be preparing taxes like a.. Everything you need to become a tax professional, in one online course! The cpa training center offers several tax preparer training courses, including a full inventory of ctp training courses and workshops, many with cpe. Our online tax preparation course gives you specialized skills, focusing on the essentials of preparing federal tax returns for individuals and small businesses. Easy and. It also prepares you to take. 49+ lessons (157 hours of ce) 15 hour annual ce requirement ; Each chapter includes reference materials. The cpa training center offers several tax preparer training courses, including a full inventory of ctp training courses and workshops, many with cpe. Easy and accuratefile with confidenceaudit support guarantee Tax preparation certifications are professional credentials that signal authoritative competence to individual taxpayers seeking assistance with their annual tax filings. Tax preparation classes help you learn how to prepare tax returns as a professional. Comprehensive tax course is a thorough, a to z guide, providing students with the tools and skills they need to prepare individual tax returns. Our program. Our program provides all the necessary books and. With our comprehensive tax classes, courses, and training program, you’ll be preparing taxes like a. Tax preparation classes help you learn how to prepare tax returns as a professional. 49+ lessons (157 hours of ce) 15 hour annual ce requirement ; The professional tax preparer certification (ptp certification) is an informative course provided by universal accounting school. If you are ready to achieve all the great benefits of becoming. Become a certified tax preparer. Comprehensive tax course is a thorough, a to z guide, providing students with the tools and skills they need to prepare individual tax returns. Each chapter includes reference materials. The cpa training center offers several tax preparer training courses, including a full inventory of ctp training courses and workshops, many with cpe. Selecting the right certification as a tax preparer involves careful consideration of several key factors, including accreditation and recognition, curriculum and course content,. Atps qualify for the irs’s annual filing season program record of completion without having to complete the coursework—gaining all the advantages that come with this tax. Commitment to excellencefurther your educationserve communitiesrigorous curriculum In this article, we will explore the top tax preparer certifications, providing a ranked list that highlights their significance, requirements, and benefits. It also prepares you to take. Written by leading cpas, eas, tax law, and ethics experts and published by the nsa, this online course covers 1040 individual taxation and ethics.Tax Preparation Course eBook Tax Bizz Training

Learn Tax Preparation courses Online with Universal Accounting School

5 Reasons to Take Tax Prep Courses With Surgent Surgent

Tax Preparation Training Class PayPal

IRS Approved Build Your Own Successful Tax Practice Universal

Best Tax Preparation Training & Courses Online TangoLearn

Training & Certification Oregon VITA & Taxaide

Best Tax Prep Courses

Intuit Academy Tax Preparation Training Credly

Tax Preparation Training Class PayPal

No Prior Tax Or Accounting Knowledge Is.

Everything You Need To Become A Tax Professional, In One Online Course!

Easy And Accuratefile With Confidenceaudit Support Guarantee

Tax Preparation Certifications Are Professional Credentials That Signal Authoritative Competence To Individual Taxpayers Seeking Assistance With Their Annual Tax Filings.

Related Post: